Considerations in relation to Fuel Tax Credits

Fuel apportionment analysis using GPS vehicle tracking can form an input to Fuel Tax Credit (FTC) claims. Before acting on any of the information produced by Prism, it is important to review the guidance provided by the Australian Taxation Office (ATO) and seek professional tax advice in relation to any claims your make.

This page describes some of the important items relevant to Prism in this regard. For information about any items not described on this page please contact us.

The items and measurement approaches described on this page are non-exhaustive and other methods or factors may also be relevant to your specific situation. We strongly advise you to seek professional tax advice in relation FTC claims using GPS-based analysis and its associated factors.

Check your GPS tracking system is recording your vehicle activity accurately

Prism relies on vehicle position and state data captured by your GPS tracking system. The data is provided by your tracking system provider either via web API or secure file transfer. Prism analyses the data as it is provided and has no control over the devices or any intermediate data processing systems used by the tracking provider.

Therefore, it is important to periodically check that:

The data being collected by your tracking system is accurate

The data being received by Prism is complete

The primary method of checking tracking system accuracy that is expected for FTC is comparison of tracking system activity, obtained from reports or tools provided by the tracking system, for a representative sample to other records of vehicle activity such delivery logs or work diaries.

The primary items to check are start and end times of trips, distance and total journey time. If your tracking system is accurately recording your vehicle activity, you should be able to demonstrate alignment of these values across different business records consistently for the sample period.

To ensure that Prism is receiving complete data, you should validate that the trips recorded in your GPS tracking system are reflected in Prism with the same values for distance and time measures. To do this you can locate specific trips in the https://help.prismapp.com.au/Home/using-the-trip-viewer .

More information regarding the use of GPS technology for FTC is available on the ATO’s web page here: https://www.ato.gov.au/Business/Fuel-schemes/Fuel-tax-credits---business/Tips-to-get-your-fuel-tax-credits-right/#Usetherightrate .

Identify and set the correct vehicle specification parameters

Maintaining accurate vehicle specification and descriptive data in Prism is important for two reason:

In an FTC claim review by the ATO you would be expected to provide a complete and accurate asset list of all vehicles included in the claim

Prism uses fuel consumption rate assumptions as an input in determining how to apportion fuel between on and off road activity. This is required regardless of whether you use Prism’s Fuel Records feature.

Fuel consumption rates are generally expected to be determined through one of the following methods:

Running live tests on your vehicles to measure the amount of fuel consumed by a vehicle when performing activities typical for your business, including driving while loaded and unloaded and idling.

Obtaining analysis of engine operating statistics from Engine Control Module (ECM) reports and other technical data accessed during vehicle maintenance.

Obtaining vehicle specification data from manufacturers technical data sheets.

Identifying fair and reasonable average values based on similar types of vehicles for which data is available.

Prism provides fuel consumption rate reference data for a number of vehicle makes, models and categories as a starting point for account set up.

It is important that you review the initial vehicle register parameters following account set up and adjust them as required based on your own information.

For more information about how to use the Vehicle Register in Prism to view and edit vehicle parameters, see https://help.prismapp.com.au/Home/using-your-vehicle-register.

Review the allocation of vehicle activity between on and off road use

Apportioning vehicle activity and fuel use between on and off road (or public and non-public) locations is a critical function of Prism.

Prism performs this by comparing each GPS position captured by your tracking system to a national data set of roads and other infrastructure built from government and private sources covering the approximately 4 million registered roads in Australia.

As the data is of vast scale, compiled from multiple sources with different accuracy thresholds and road infrastructure is continuously evolving, this process can never guarantee complete accuracy in every location at any point in time. Therefore, Prism uses a process of continuous evaluation to keep its data up to date which includes analysis conducted by our team but also feedback from users.

To enable Prism users to determine if on and off road activity has been correctly classified for their vehicles, several tools are available to visualise and review the apportionment.

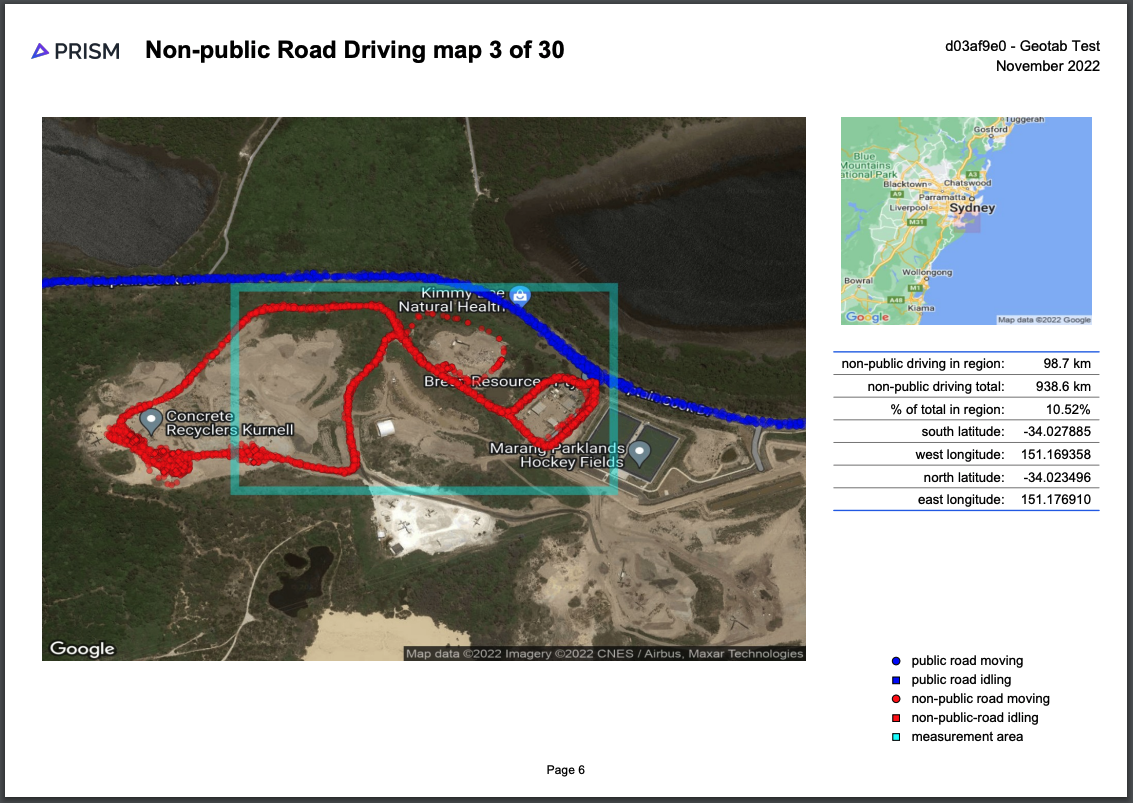

Cluster map reports

Prism’s cluster map reports identify clusters of activity that are the most significant contributors to on and off activity within a month across all vehicle activity.

These reports allow rapid focus on the locations that are having the largest impact on the overall fuel apportionment result in the period. This avoids the need to review hundreds or thousands of individual trips to find the locations that are most important.

Reports are produced to show the top locations for driving and idling that is classified off road. The example below shows a site identified in one of these reports. This allows users to determine if significant locations are represented accurately in Prism.

Trip map reports

Prism’s trip map reports identify specific trips that have the highest allocation of time or distance for on and off road activity.

These reports provide a further point of validation for significant locations and also provide statistics for the trip that validate the GPS activity.

Trip Viewer Tool

The Prism web portal contains an interactive trip viewer tool that allows specific trips for any vehicle on any date to be analysed.

This is useful for looking up vehicles that operate on known routes or schedules to confirm their activity is accurately represented and that the locations they visit which are off road are correctly captured.

Audit Point Files

Prism can make all underlying GPS point data available to users for download. This allows users to analyse the entire data set used to generate Prism reports in any Geospatial Information System (GIS) which allows users to conduct any further bespoke analysis they may require in their own analysis environment.

If you identify any inaccuracies in the assignment of on or off road activity classifications, please contact us so we can evaluate and, if required, rectify the issue.

The Prism team is always keen to hear of any ideas for new features that can aid users in validating their vehicle activity and fuel apportionment data.

Choose the right FTC calculation methodology

The vehicle activity and fuel apportionment calculations performed by Prism provide information that may be used in a number of ways for FTC calculations, depending on which calculation methodology you are using.

While the Prism team cannot provide you with any guidance in relation to choosing the right FTC calculation methodology for your business, we advise that your read the ATO’s Practical Compliance Guide which describes several commonly used methods that are considered fair and reasonable.

If you require assistance with choosing an FTC methodology and using Prism information as an input, our team can refer you to a registered tax agent who specialises in FTC claims.

Keep the right records

Prism is designed to reduce the overhead of recording and using detailed GPS and vehicle data for FTC but this represents only part of the records relevant to a claim. All taxpayers are expected to keep accurate and complete records to support their claims, including those related to data validation and calculations performed outside any technology systems like Prism.

We cannot provide a complete list of all records that you may need to keep for your claims as this is case dependent, so please review the ATO’s web page related to record keeping for FTC here: https://www.ato.gov.au/business/fuel-schemes/fuel-tax-credits---business/working-out-your-fuel-tax-credits/records-you-need-to-keep/.

ATO audits can be daunting, and it is best to be prepared. If you are facing an audit or expecting one soon, we have created a free tool to help you track the necessary items here: https://prism-cblcq6we.scoreapp.com/ .